Cybercriminals are changing their tactics much faster than they used to, and the finance industry is one of their main targets. This article will dive into the most important types of mobile fraud in banking and how to prevent them with secure communications.

In recent years, more financial organizations have relied on mobile messaging to communicate with their clients. The reason is quite simple: it’s what their audiences demand.

According to research, 64% of consumers with texting capabilities prefer texting over voice as a customer service channel. Besides, 81% of all consumers agree that it is frustrating to be tied to a phone or computer to wait for customer service help.

Effective and quick channels are fundamental in an industry where time-sensitive and confidential communications are constant. “SMS is one of the most effective channels for banking communication. It has a 99% of read rate, and its response time is faster than any other channel.”, said Jane White in our webinar called “Protecting your financial institution from mobile fraud”.

And she added: “When you want to send a critical message to an account holder quickly, like a transfer funds alert or a one-time password, it should be sent through mobile messaging.”

The problem is that new communication channels come with vulnerabilities. “Fraudsters are operating in organized teams. They are groups of engineers working with advanced technology, making many attacks at once instead of a one-to-one attack,” commented Jane White.

Financial organizations must be proactive to prevent costly data breaches via mobile messaging.

Most Common Types of Mobile Fraud in Banking

According to the Mobile Ecosystem Forum, there are 14 types of SMS fraud. In the finance industry, two protagonists are Message Trashing and SMS Pumping.

Message Trashing

Suppose a bank wants to send many messages to account holders for marketing reasons. Message Trashing fraud occurs when the messaging provider sends false delivery receipts to the bank and trash some of the messages instead of sending them to the end recipients.

It is a common type of mobile fraud in banking. The best to prevent message trashing is tracking and reporting on the messages that go out and checking if they meet the expected response rate.

If the response rates are much lower than expected, you can dive into the read receipts received and see if they have some false information.

SMS Pumping

Suppose you have a web form for one-time passwords that receive a lot of traffic, but nobody logs in. Well, you can be a victim of SMS Pumping.

Artificial Traffic Inflation, also known as SMS Pumping, is one of the most complicated and impressive fraud types.

Any website, app or platform with a web form is a potential victim of this fraud. It is prevalent for banks, especially because many web forms have a one-time password response to whatever is input into the web form.

Often, a cybercrime organization will steal huge buckets of login information and use these numbers to spam the forms. The web form will start receiving a considerable number of requests, and the traffic will spike.

Then, the originator will receive an inflated bill, and whoever is misbehaving will give a kickback and do revenue sharing with the cybercrime organization that orchestrated the fraud.

To prevent SMS Pumping, you need an orchestrator that can help you report inflated traffic and lock the web forms down only to receive a certain amount of one-time passwords at a time.

Also, you should pay attention to suspicious activity, like consecutive numbers. If you have a lot of numbers ending in 0000 or 99999, your website could be spammed.

How to prevent mobile fraud in banking

Mobile fraud prevention in banking goes much further than educating account holders against fake bank messages. Nowadays, it’s not just the end user of the messages who want to be proactive; it’s all four points of the communication chain, from the creator to the originator.

At Soprano, we recommend the financial industry have in place to prevent the 14 types of fraud. Multi factor authentication, one-time passwords in banking, and single sign-on are the basics.

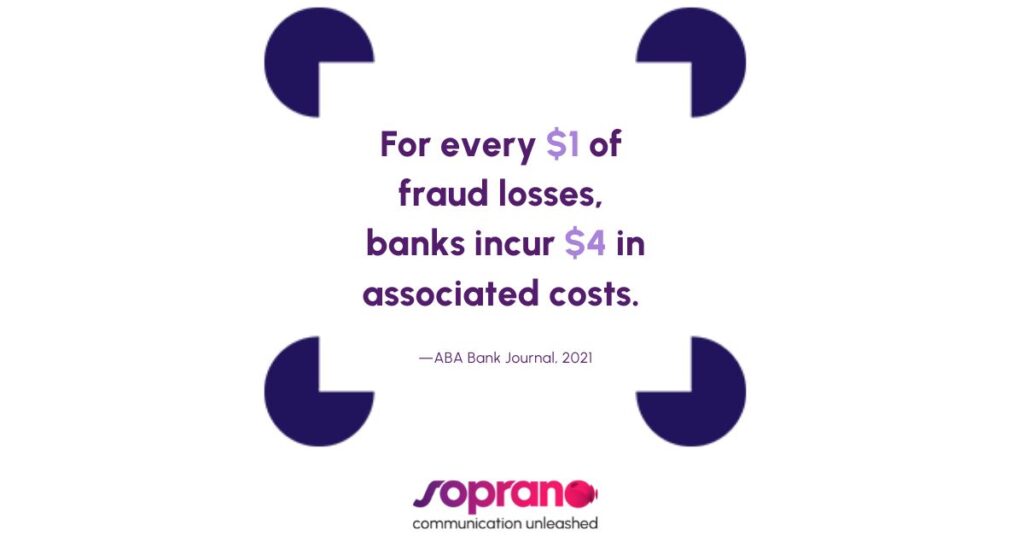

But as the consequences of mobile fraud in banking are devastating, protecting internal systems with the maximum high level of security that you have available is crucial.

Here are some security features every financial organization should consider when choosing a mobile messaging orchestrator:

IP Access Control for internal systems

Because we know that 99% of access hacking and data breaches are due to compromised login credentials and remote-work-friendly culture, financial institutions need to use additional measures to protect against malicious accessing their software tools.

IP Access Control allows admins to restrict access to pre-approved IP addresses. With this feature in place, if somebody has SIM Swap successfully or intercepted the roaming on your employees’ devices, the cybercriminal could have a one-time password but still not gain access to your internal systems.

Simple Template Messaging

Admins can define standard templates to be used across the organization. This feature is vital for brand consistency, compliance, and approved messaging for banks with multiple regions and branches.

Templates allow to standardized messages for lower-level users. With Simple Template Messaging in place, you will not run into an issue where authorized messages attack your account holders from an inside system.

“Outside actors can use internal systems to smash account holders, and it’s one of the worst types of fraud in the banking industry because it corrodes trust so quickly that it is devastating,” commented White during the online seminar.

Cover multiple communication points

As we mentioned before, all members of the communication chain are responsible for preventing mobile banking fraud. It is about educating the end user, using IP access controls on your internal system, and working with an orchestration partner built for security and with reputable MNO partnerships.

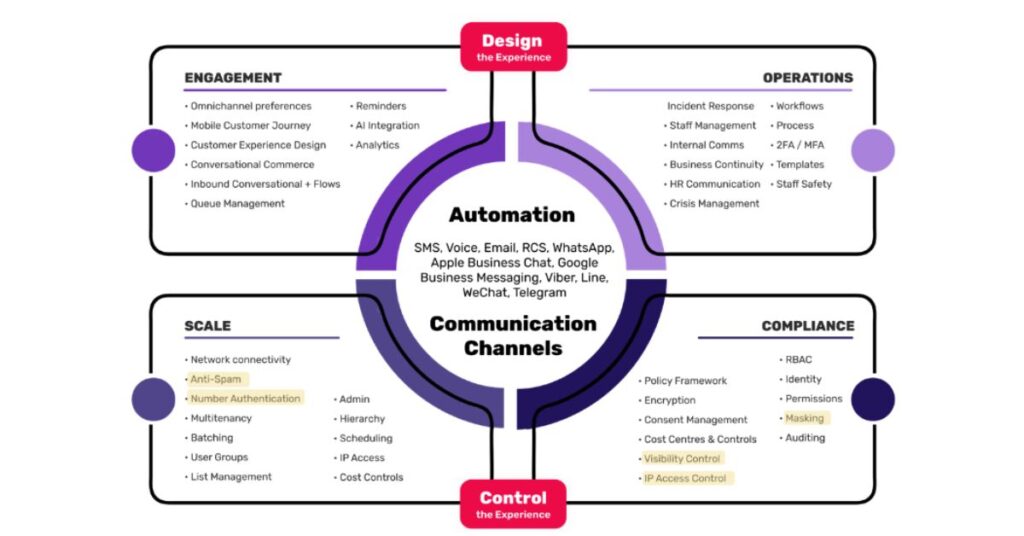

At Soprano, we focus our orchestration platform on engagement, operations, scale, and compliance. We know it is just as essential to keep a secure infrastructure around messaging as it is to make the messages good and go through specific channels.

Do you want to learn more about Soprano’s secure communications platform? Our team would love to talk with you,